Finding the right tools

Anthemis Group is a London-based investor in early-stage and growth-stage companies particularly in the fintech and insurance sectors.

For investors like Anthemis the total amount of available useful data to support investment decisions is very small. Getting the most out of this data is a different problem to the one confronting traditional investors in more mature companies where data is abundant. Perhaps because of this the market for decision-support tools for venture capital companies is much less mature.

But there’s too much going on to rely completely on spreadsheets unless you’ve got an army of associates to keep them up to date for you. Here are some of the things we’ve automated at a relatively small VC company.

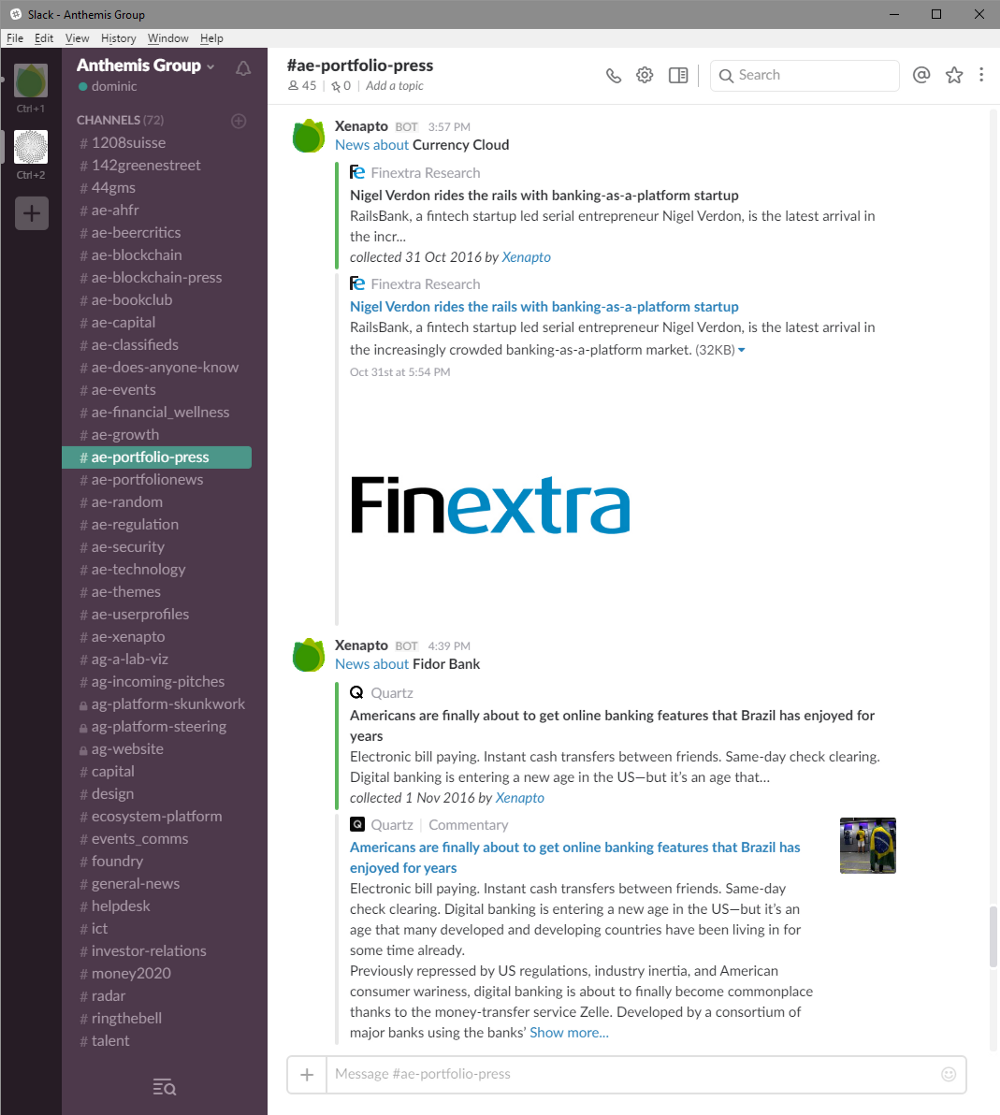

Portfolio news in Slack

When a press article appears about one of our portfolio companies we get notified about it in a Slack channel. We’re big users of Slack as you will see.

We can add new news sources at any time. And adding a new portfolio company is as easy as adding a tag to a contact in our database.

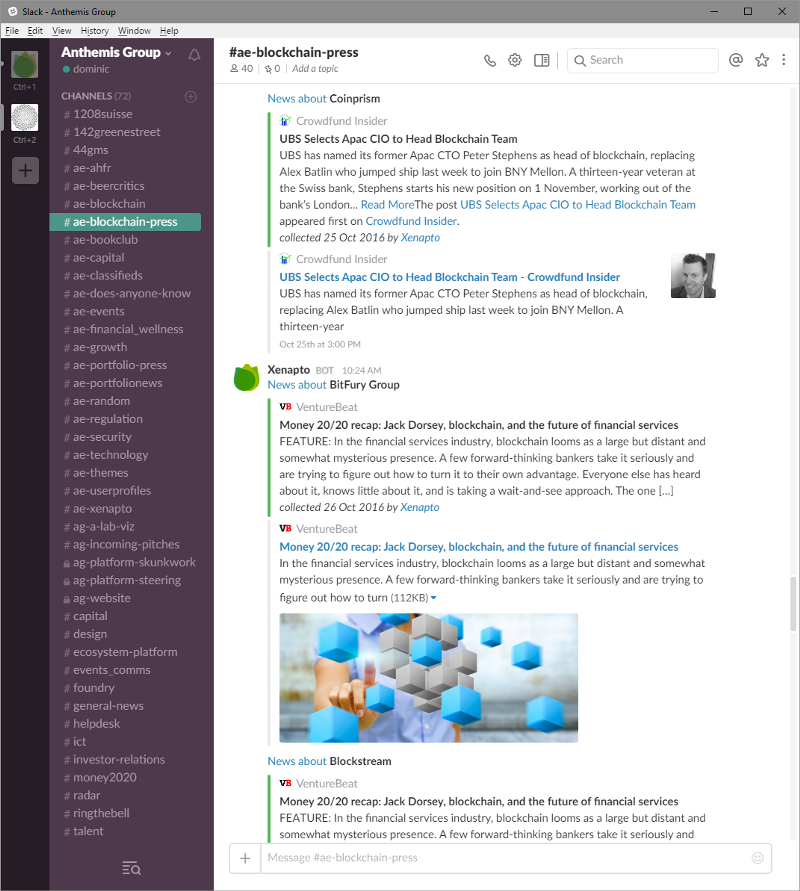

Category news in Slack

We’re also interested in news stories about certain industries. In this example we’re seeing press articles about blockchain companies, for example:

Once the company is added to our database we just need to tag it with blockchain for it to start appearing here when it gets press coverage.

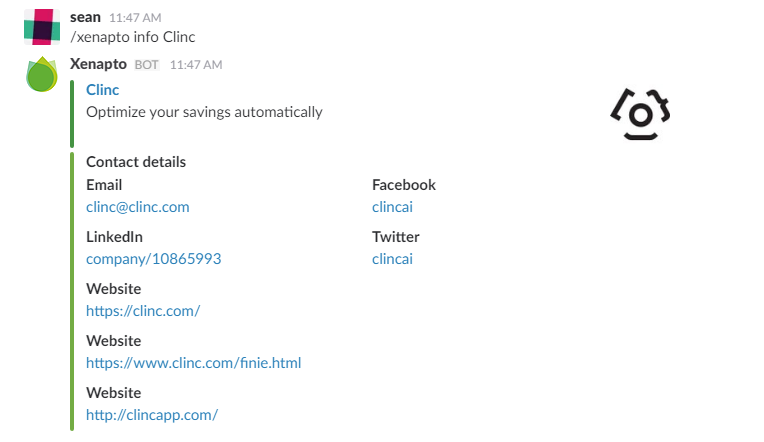

Company queries from Slack

While we’re in Slack, we might want to discuss or share information about a company from our database. We’ve got a Slack command for that:

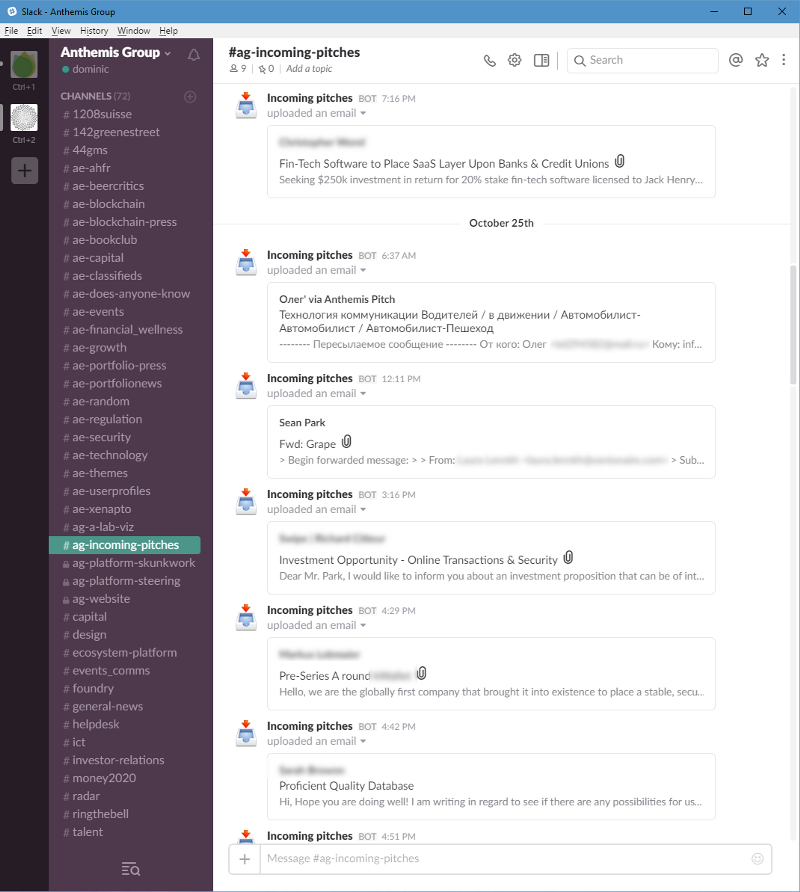

Incoming pitches

Companies who are looking for funding often send us their pitches. This happens several times a day and it would be a time-consuming manual task to add the company to our database, upload the pitch document and copy-and-paste the email as a note.

Instead we’ve automated the process. When a pitch request arrives it first of all gets sent to a Slack channel to notify our investment team:

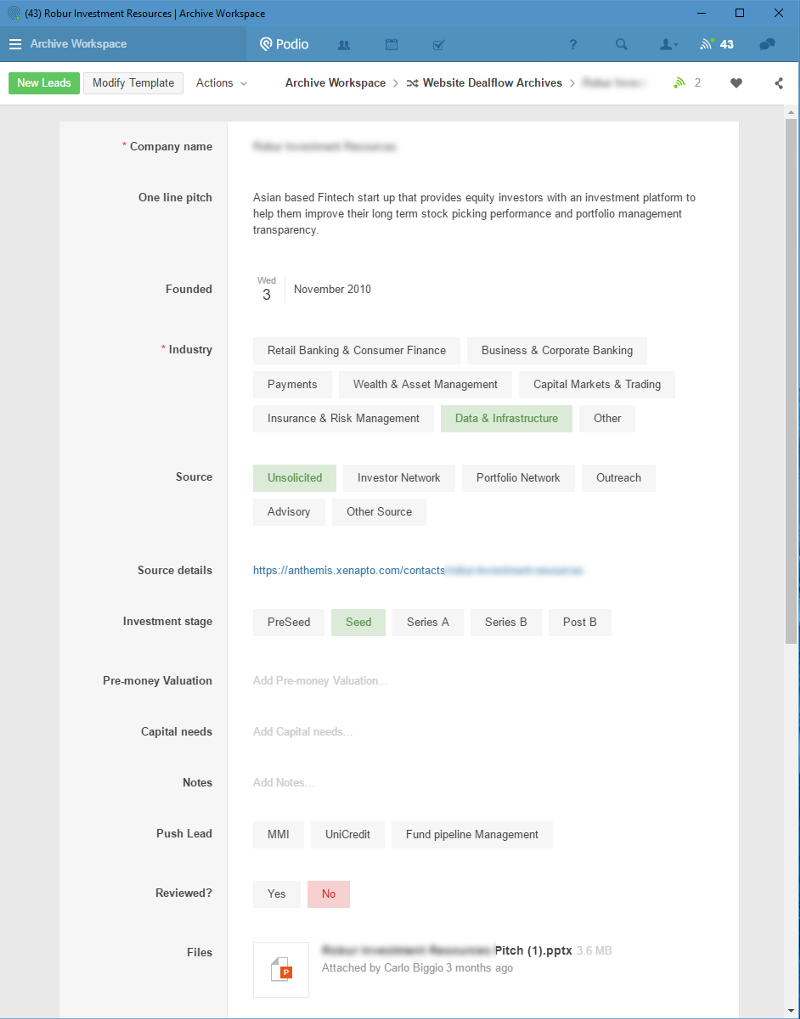

Then it gets added to a list of companies waiting for triage. This happens in a Podio app that we’ve built to manage the selection process:

Managing the investment pipelines

Yes, that’s pipelines plural. We may be allocating capital from our current fund while we’re looking for target companies for the next fund in 12 months time.

We also have partnerships with corporate investors who may have different investment criteria from our own funds. That means we need to build a separate shortlist for each investment partner.

We can add companies manually into the Podio app:

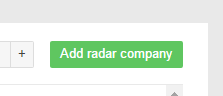

Or using Evernote’s Web Clipper we can add a company to an Evernote notebook. Companies added to this notebook get automatically added to our database and to the investment long-list.

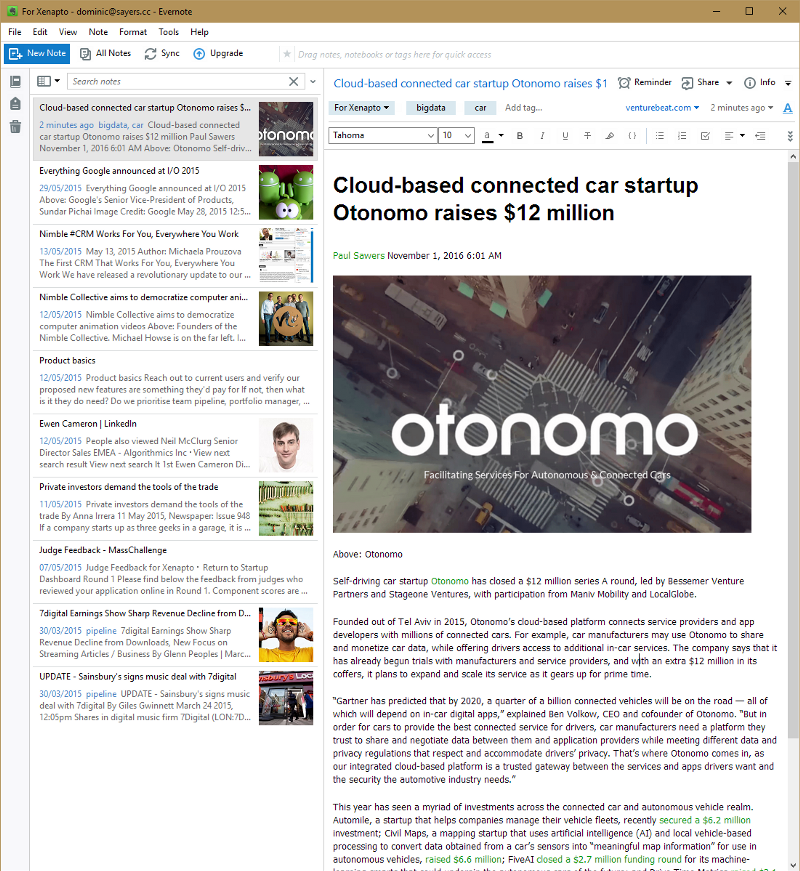

Finally there’s good old Slack. If we discuss a particular company in this magic Slack channel it gets added to the list automatically:

Gathering information

During the basic research on a company can be another time-consuming task, and not a very rewarding one.

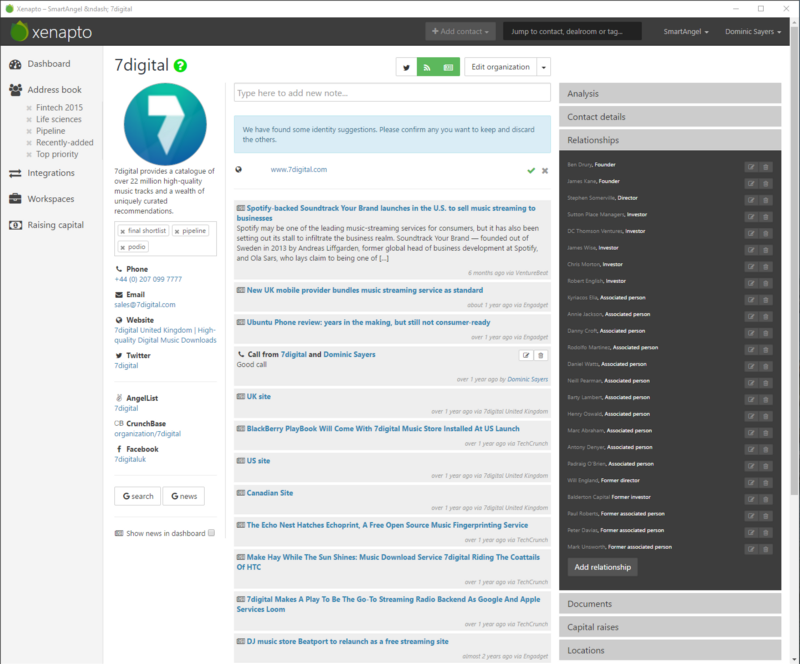

We’ve automated the gathering of basic information, using data sources that are free (such as news publishers and PR aggregators) and others that cost us money (like Crunchbase for example).

This is all pulled into a central database where the company details are stored, along with associated people like founders and advisors. We store details of previous funding rounds and current investors. We listen to the company’s Twitter feed and its own news updates.

This is the central component of the system but it’s one of the least used by actual people. The investment team prefer to use Slack, Podio and Evernote to do their jobs so the central database is a source of data and a receiver of updates from these applications rather than a place where they spend their time.

Research & development

We’ve built some time-saving tools but there’s much more we plan to do.

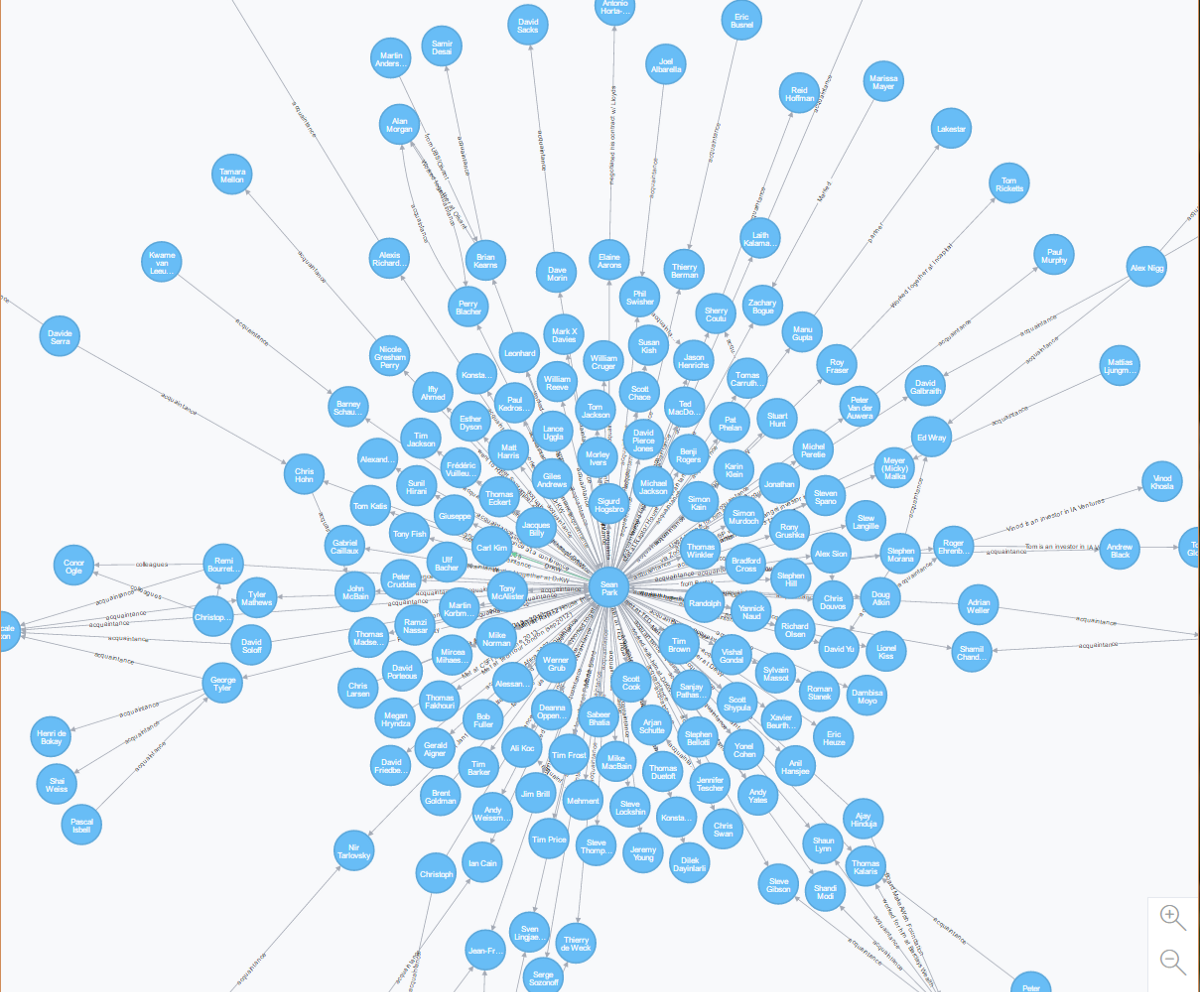

The central database is a sizeable resource of relationship data that we’re starting to put into a social graph format, like a private LinkedIn. This will let us analyse the ecosystem formed by our portfolio companies, advisors and co-investors to find ways they can help each other better:

It’s amazing what you can do with a relatively small amount of data.

What now?

Using productivity tools like Slack, Evernote and Podio lets people be flexible about how they work, and we delegate the user experience to the apps they are already happy with. Its a win-win from our point of view — our people get the best-of-breed tool and we don’t have the cost of trying to build equivalent user interfaces.

There are workflows that are too complicated for general-purpose productivity apps. Things like event management and capital raising need specialist systems and we’re rolling these out now, but so long as all the teams can share data across the systems we’re in a good place.

The company evolves very rapidly. Its information architecture is evolving along with it. It’s impossible to say what tomorrow’s requirements will be but it will be fun finding out.